The following post was co-authored by Russo on Energy Partner, Tom Russo.

__________________________________________________________________________________________________________

LNG Peak Shaving Plants costing between $12 million and $200 million are a proven alternative to gas pipelines and large underground storage facilities. They can also ensure deliverability to gas-fired power plants for short periods during extreme weather conditions when natural gas prices peak or where pipeline capacity is constrained.

North America’s Shale Gas Revolution has produced abundant and inexpensive natural gas, which has begun to green the electric power sector. From 2007 to 2012, U.S. annual carbon dioxide emissions reductons led the world at 725 million metric tons, equivalent to total emissions from Germany. Gas-fired power generation now accounts for about 35% of the total U.S. power generation and continues to grow as it displaces coal-fired generation. The growth in gas-fired generation has taken advantage of a 300,000+-mile natural gas pipeline system, over 400 gas storage facilities, and 50 peak shaving plants constructed over the last 60 years. Even in California, which prides itself as a leader of renewable power, the State relies increasingly on gas-fired power generators, particularly to ramp up when wind and solar generation is insufficient to meet power demand.

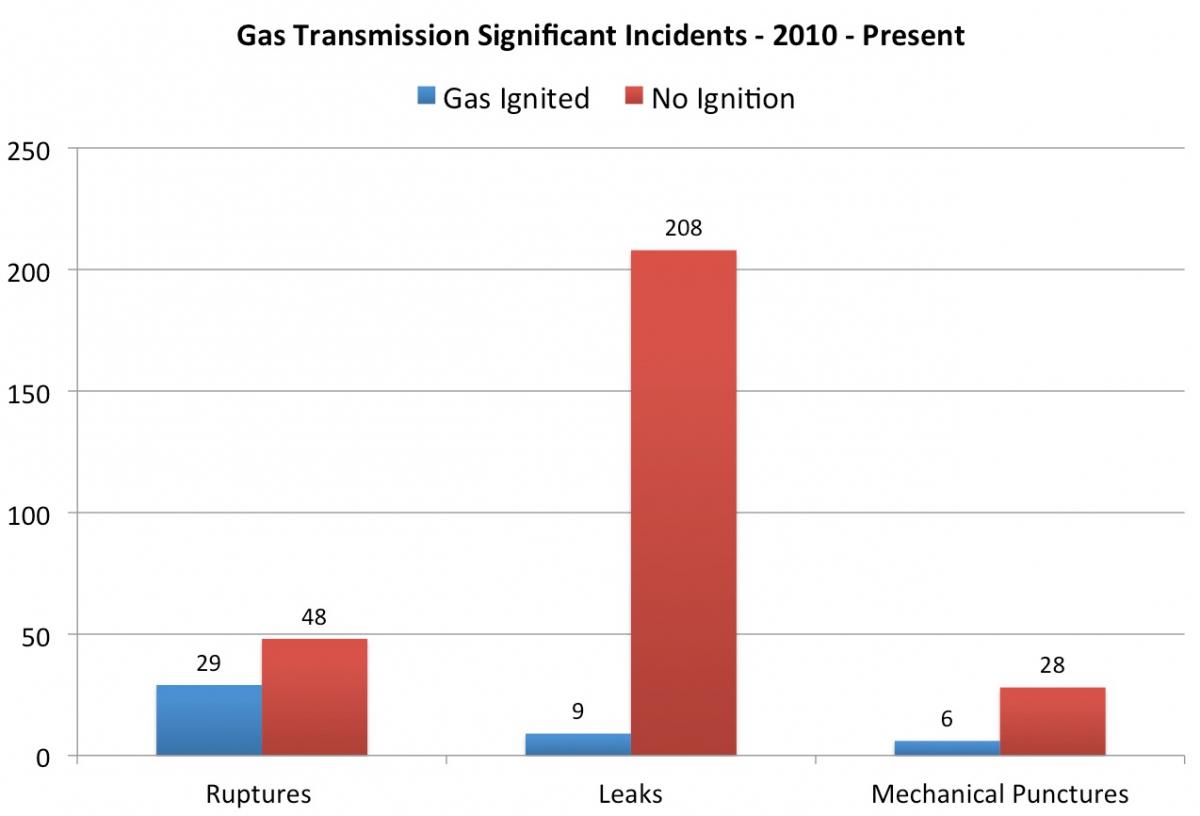

Recently, though, some natural gas pipelines and a large underground gas storage facility have begun to show their age. An increasing number of pipeline leaks, some causing fatalities and property damage, most notably in San Bruno, CA, in 2010 have prompted PMHSA, the Pipeline Safety Regulator this May to propose an overhaul of current regulations. Moreover, the worst natural gas leak in the nation occurred from October 23, 2015 to February 18, 2016 when a significant amount of gas leaked from California’s Aliso Canyon Gas Storage, an underground facility owned by Sempra Energy. The gas leak displaced two schools, forced the evacuation of 8,000 families and generated thousands of sickness complaints. In addition to the safety and health concerns, natural gas (methane) is a potent greenhouse gas, considered to have the same effect on the atmosphere as 21 times the amount of carbon dioxide.

Source: Pipeline Safety Trust

Is it Time to Rethink Gas Infrastructure?

Conventional thinking in the gas industry in the past has been to respond to demand by building facilities as large as possible in order to take advantage of economies of scale. The focus on large projects applies to both pipeline and storage capacity when proposing projects. When done right, this has resulted both in lower costs to the consumer and higher profitability. Returns on equity for interstate natural gas pipeline companies, which are natural monopolies, average slightly above 12%. The rates that interstate pipelines can charge customers are based on the cost of service and are regulated by the Federal Energy Regulatory Commission (FERC). The agency has been investigating several pipelines whose returns on equity ranged from 15.8% to 24.9%.

We have seen however, that the “one size (big) fits all” approach has increasing difficulty getting public, political, and regulatory support and approval to build projects. We believe that a more nuanced, “right-sized” approach that promotes safety, environmental and public objectives have a better chance of success and can serve a growing power sector.

Accidents resulting from aging natural gas facilities give ample ammunition to environmental critics who wish to limit the use of natural gas from the electric grid. These critics and the public want to promote clean energy goals, but not disadvantage or overwhelm the continued growth of renewables. In the abstract, however, there is general agreement that natural gas for power generation is needed on a large scale, until utility-scale electric storage becomes more widespread and economical.

Accidents with natural gas infrastructure are becoming more common. When events like Aliso Canyon make headlines, the natural gas supply chain, including end users, will feel the consequences. That includes global gas infrastructure projects and investments. Increasing public opposition to new pipelines and storage facilities when combined with local and State fracking bans is reaching a point where government agencies that routinely condition and approve gas infrastructure may just deny the permits due to public opposition. That question has already been answered as we have already seen State agencies, generally more responsive to local political pressures, deny required Clean Water permits that FERC and other federal permits would normally be conditioned on. A State denial of a section 401 Clean Water Act permit is equivalent to FERC denying the certificate of public convenience and unless reversed results in no projects being built.

Challenges in Today’s Environment

Clearly the natural gas industry must rethink its current approach and develop an approach that minimizes the safety and health risks to local communities while supplying natural gas to its customers, including the power sector, the largest source of growth. The Challenges to the industry are several:

- Become more nimble in how it delivers gas, as gas-fired power generation grows and increasingly becomes the fuel “at the margin”, as it ramps up and down in response to electric demand and preferential (either economically or politically) use of renewables.

- Recognize that the power sector values “deliverability” of gas rather than pipeline capacity. The Environmental Defense Fund recently told the Senate Committee on Energy and Natural Resources that the existing compensation scheme based on capacity for pipelines needs to change and that customers want enhanced deliverability. Continuing to promote ever-larger and more expensive projects that focus on capacity alone will face increasing opposition for safety, environmental, and cost reasons. The end result is more cancelled projects where no one wins in the end.

- In an economy that shows all indications of continued slow growth, pressure will increase to use existing infrastructure more efficiently rather than put additional costs on customers. Although commodity prices are currently low, utility charges to customers continue to increase, something that will become more and more evident as commodity prices normalize.

- The industry has to recognize that it has a problem with “public trust,” especially when it comes to safety, public health and environmental impacts. These problems manifest themselves in public opposition to newer projects. To gain the public’s trust, the industry and individual companies will have to go well beyond following safety regulations and guidelines. They will also have to recognize that no person will believe they will be able to derive benefits individually from infrastructure, if they believe that it poses a safety or health risk to them. Quite the opposite is true; the person opposing a gas infrastructure facility is actually making a rational choice to oppose a project, if they feel a risk exists.

Fortunately LNG peak shaving plants are a viable option for numerous reasons that can help meet the above challenges.

LNG Peak Shaving Plants- a smaller, low cost, distributed approach

We believe that LNG Peak Shaving can address numerous issues discussed above and definitely improve the efficiency of existing facilities. More important for the power sector, LNG peak shaving can ensure deliverability of gas when it is needed.

Peak shaving is one the most common domestic uses for LNG today. In fact, peak shaving facilities have been a critical element of many gas utilities to ensure that there are sufficient gas supplies to serve their customers during the heating season. Some gas utilities don’t use peak shaving, because they can rely on large underground storage facilities like Aliso Canyon to store low cost gas for use during peak times. However, where underground storage is not an option, many gas and electric utilities buy gas during times when prices are lower and store the gas in above ground peak shaving facilities until it is used later either during winter or summer.

The term “peak shaving” is when LNG is stored near a gas utility’s distribution line or at a power plant. Then in times of peak demand for gas or electricity, the utility or power generator can tap into the LNG to serve gas customers and increase power output, respectively. This most often occurs during the winter and summer months when abnormally cold or hot temperatures cause spikes in natural gas and electricity demand.

There are two types of peak shaving facilities. While both types have on-site LNG storage tanks, one has on-site liquefaction facilities and the other lacks on-site liquefaction capabilities. Peak shavers with liquefaction facilities are able to take natural gas directly from pipelines or gas utility distribution lines, liquefy it, and store it for later use. Peak shavers without liquefaction facilities are also called “satellite facilities.” They must rely on LNG tanker trucks or barges to refuel their LNG storage tanks.

UGI’s LNG Peak Shaving Plant with Liquefaction and 3-million-gallon storage tank near Reading, PA

Source: High Horse Power Insight (HHP Insight)

Satellite Peak Shaving Plant (no liquefaction capacity) for Greenville Public Utilities

Source: Northstar Industries LLC

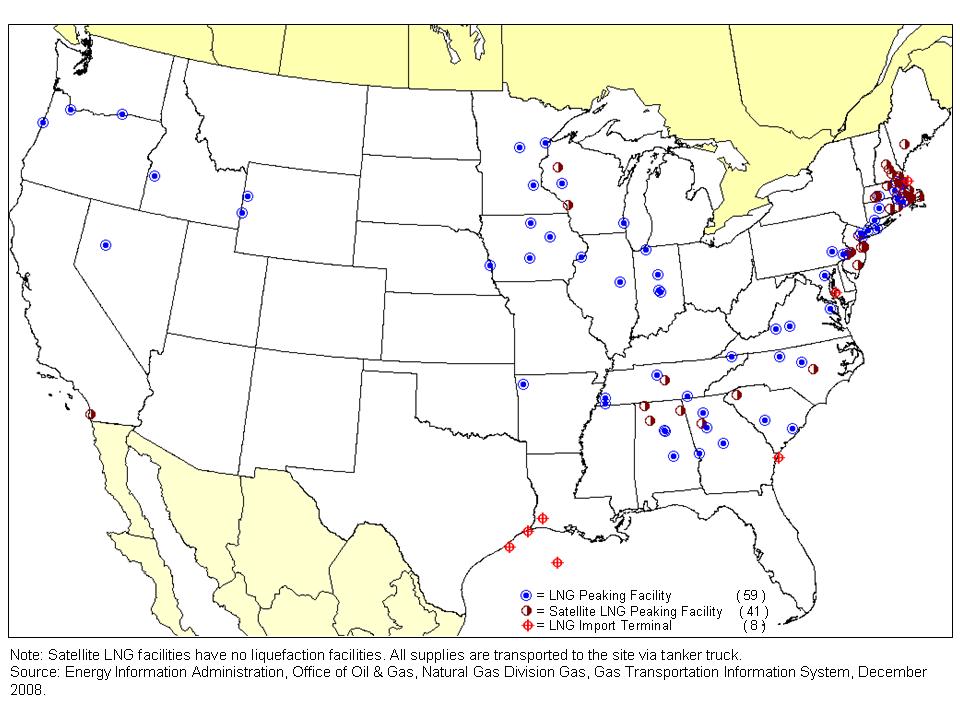

There are over 50 operating peak shaving facilities in the United States today. One half of peak shaving facilities are located in the Northeast while a quarter are located in the Midwest. Of the over 1.3 billion gallons per year of peak shaving capacity in the United States, almost 1 billion or 77 percent is located in these two regions.

Location of LNG Peak Shaving Facilities in the U.S.

Source: EIA

LNG Peak Shaving Plants for Power Generators

Both Satellite and Peak Shaving Plants with liquefaction capability can be a viable substitute to large underground natural gas storage facilities and additional build out of the natural gas pipeline systems. This is especially relevant if gas pipeline constraints only cause electric reliability problems for short periods of time or existing facilities are not safe to operate.

Satellite peak shaving plants can be constructed on the footprint of many small gas-fired power generating stations (<150 megawatts) and serve as a reliable fuel supply for short periods of time. These facilities require that LNG be trucked or barged in to the satellite peak shaving plant. Vaporizers at the plant convert the LNG into gas for power production for a period of time commensurate with the LNG stored.

|

Some typical costs for various size Satellite LNG Plants are shown below:

|

This compares very favorably with the all in costs of converting a gas-fired plant to dual fuel capability, i.e. one that can burn no. 2 fuel oil or ultra-low sulfur diesel. Additionally adding LNG, as a back up fuel will not create any operating or emissions issues for a power plant, since it is merely using and storing the same fuel. At the same time, the cost of LNG should be lower than the cost of fuel oil under most scenarios, although the actual cost will depend on very local factors of things like transportation cost.

For power plants exceeding 150 megawatts, Satellite Peak Shaving Plants are inadequate as the number and frequency of trucks and trips to the facility become unmanageable. When this occurs, a Peaking Shaving Plant with Liquefaction Capability is the better option. For those, power plants located behind a CityGate, a gas utility can provide gas supplies at a reasonable price during the non-peak season. The Peak Shaving plant would liquefy the gas and store it for use when the power generating facility needs it. In the case when the power generating station is located on an intrastate or interstate natural gas pipeline, the power generating station can also procure gas supplies during non-peak times when prices are lower.

Peak Shaving Plants with liquefaction capacity are more costly than satellite plants. Their footprints are larger too and most could not be accommodated at the site of a power generating station. Also, the power generator or the gas utility would have to construct additional distribution lines to transport the vaporized gas to the power plants served by the Peak Shaving facility. The cost of a liquefaction plant would nominally be $30-40 million in addition to the costs above ($12 million for the Satellite Peak Shaving Plant). The increased cost will be driven by the storage costs. For example, if you were to build a 1 Bcf storage tank, that would be $100 million or more. So a full-blown peak shaving plant with a liquefaction plant, 1 Bcf storage, and vaporization, can easily be $200 million. The assumption for the Satellite plant was for small bullet tanks that are shop fabricated.

How Peak Shaving can improve efficiency and alleviate pipeline constraints

Peak Shaving facilities are not a new technology and have been around for several decades. We’ll first take a look at their current operations and use in New England. We’ll also compare them with going ahead with Williams’ proposed 124-mile Constitution Pipeline, which is being delayed by the New York Department of Environmental Conservation. The pipeline is estimated to cost $683 million and would move Marcellus gas to customers in New York and Massachusetts. Even a larger peak shaving plant with storage would cost approximately $250 million for a plant with liquefaction capability on a green field site. Since the cost of storage is the majority of the total facility cost, expanding the capability of an existing peak shaving plant to produce a greater amount of LNG, and to refill storage at least partially after a drawdown, would only be a small fraction of that cost, depending on the specific facility.

New England is fortunate in that it has adequate LNG resources. In addition to the LNG import terminal at Everett, MA, which has a storage capacity of 3.4 Bcf, and the Northeast Gateway and Neptune offshore facilities, there are 46 liquefaction and satellite storage tanks located in Connecticut, Maine, Massachusetts, New Hampshire and Rhode Island owned and operated by Local Distribution Companies (LDCs) or gas utilities. The total combined storage of peak shaving and satellite storage is about 18 Bcf. Cumulative vaporization capacity of these storage tanks, plus that from the Everett facility, is approximately 2.3 Bcf/d, which can supply as much as 50 percent of the region’s peak day needs. Gas utilities in the region also have about 260 propane tanks in the region with a total storage capacity of 1 Bcf of liquefied petroleum gas (LPG). Vaporization from LPG can meet 5 percent of New England’s peak day needs.

Increasing the Efficiency of Existing Peak Shaving Facilities

We now take a harder look at the utilization of the existing peak shaving plants in New England. Keep in mind that construction and operation of these LNG peak shaving plants have been approved by the State Public Utility Commissions, so they are ratepayer funded. Gas utilities will call on these facilities during winter to mitigate prolonged or very cold winter weather that will require gas to serve their customers. We estimate that less than 50% of the existing LNG Peak shaving capacity is utilized by gas utilities during the typical winter. Power generators behind a CityGate should be able to call on this additional gas, because they are not subject to existing interstate natural gas pipeline constraints common during the winters in New England.

If gas utilities have adequate supplies at their Peaking Shaving plants and don’t need to make additional gas purchases, then this frees up transportation capacity on interstate pipelines or at least allows Gas utilities to release their pipeline capacity to others. Theoretically, a gas utility should also able to sell excess LNG from its peak shaving facilities and pipeline transportation to power generators upstream of the CityGate, since it doesn’t need both to serve its customers. Whether a gas utility has the incentive to do so is more of a regulatory question. Currently,

Most gas utilities are not using their excess LNG from Peak Shaving plants, because they simply don’t have to or there is no incentive to do so. This illustrates that while much discussion has been focused on building additionally pipelines into the region, such as the 124-mile long Constitution Pipeline, the existing LNG Peak Shaving facilities in New England are not being efficiently used.

California would require many Peak Shaving Plants

Several questions immediately arise when considering LNG Peak Shaving Plants in lieu of the 87 Bcf Aliso Canyon Gas Storage Facility. A large number of LNG Peak Shaving Plants would have to be constructed to mitigate the loss of the Aliso Canyon. In fact, the 46 peak shaving plants in New England have a total capacity 15 Bcf, which is actually equal to the volume of gas stored presently allowed at the Aliso Canyon facility.

At this time, the public, energy, and State officials are hotly debating whether or not to shut down the Aliso Canyon facility or whether it is really needed for electric reliability. Even if the decision was made to close the Aliso Canyon facility, the State of California could consider authorizing several Peaking Shaving Facilities with liquefaction to physically hedge gas supplies to the 17 gas-fired power-generating plants in the vicinity of Los Angeles.

More important is the matter of sourcing LNG for any Satellite Peak Shaving Plants. There are currently no LNG Import Terminals in California to supply Satellite Peak Shaving facilities. However, Sempra Energy, which also owns the Energia Costa Azul LNG facility in Baja California, could be a source of LNG for peak shaving plants in California. Other possibilities include the proposed Kitimat LNG project, a joint venture of Chevron Canada Limited and Woodside Energy International.

Peak Shaving and Electric Reliability

Individual State Clean Energy Programs and similar programs for the Armed Forces are mandating increased use of renewable energy. California’s desire to produce 50 percent of its electric power is just one example. Congress' 2007 National Defense Authorization Act also requires the Army to consume 25% of its electricity from renewable sources by 2025. All of these programs contain provisions to ensure electric reliability at reasonable costs. Some like the U.S. Air Force place a premium on it. The Air Force wants to ensure that activities at their facilities are able to operate even if the commercial electric grid is down for whatever reason.

Peak Shaving plants with their relatively small footprint can play a vital role in ensuring electric reliability by allowing gas fired generation to follow wind and solar. In specific circumstances, they can also ensure that power generation can independently continue should the commercial electric grid be in operable. The redundancy provided by numerous peak shaving plants can also reduce the risk of a major outage on a large gas storage facility and/or pipeline.

While the number of clean energy mandates are increasing. Without consideration of how power will continue to be supplied when intermittent renewables aren’t available, these clean power goals will never be met. Right now, these programs cannot be achieved in a reliable, clean and cost effective manner without something like natural gas to follow intermittent wind and solar power generation. Until utility-scale electric storage projects become more widespread and cost effective in todays electric grid, only gas-fired power plants and pumped storage hydro, where available, are the only dispatchable plants available to ensure electric reliability.

Conclusion

Natural gas and specifically relatively small LNG peaking shaving plants can reduce environmental, health and security risks to communities and ensure increased electric reliability to regions when the electric grid and/or larger natural gas storage and pipeline systems are inoperable.

About the authors

Frank Katulak is a Senior Executive with over 30 years of extensive Operational, Technical, Commercial and Government/Regulatory experience in the LNG and Natural Gas Industry. He was CEO of GDF Suez Gas North America, a Business Unit of GDF Suez Energy North America, until December 2015, leading an integrated LNG business with extensive operations in the Northeast US, and activities in the global LNG trade.

Tom Russo is a former FERC regulator with over 30 years experience in natural gas, LNG, and hydropower infrastructure siting matters. He specializes in analyzing how energ markets affect energy infrastructure investments and in environmental impact assessment and risks.