Responsibly Sourced Natural Gas: Time to Change the Natural Gas Industry’s Narrative

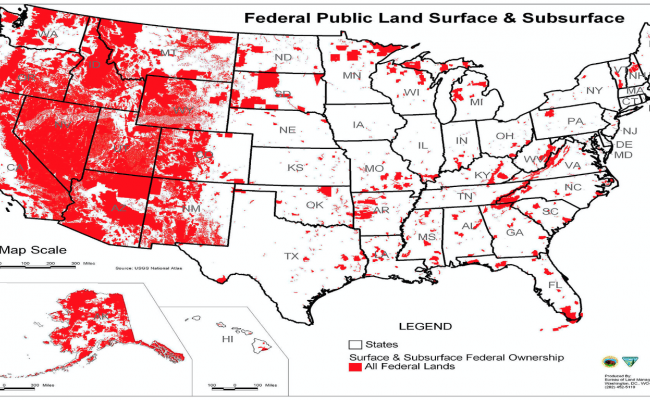

The majority of companies in the natural gas and liquefied natural gas (LNG) industry seem fixated on promoting natural gas as the clean “bridge fuel” to further deployment of renewable energy technologies. While natural gas emits far less carbon dioxide (CO2) than coal or oil used to generate power and heat, , it still is a “fossil fuel” that contributes to the adverse effects on climate. Fossil-fuel opponents are increasingly skeptical of the climate benefits reported by the US natural gas and LNG industry. These opponents often cite a study released in April 2020 that showed methane emissions from the Permian basin of West Texas and New Mexico, one of the largest oil-producing regions in the world, are more than two times higher than federal government estimates.

The time has come for the natural gas and LNG industry to recognize that the “bridge” for natural gas may be much shorter than previously thought.

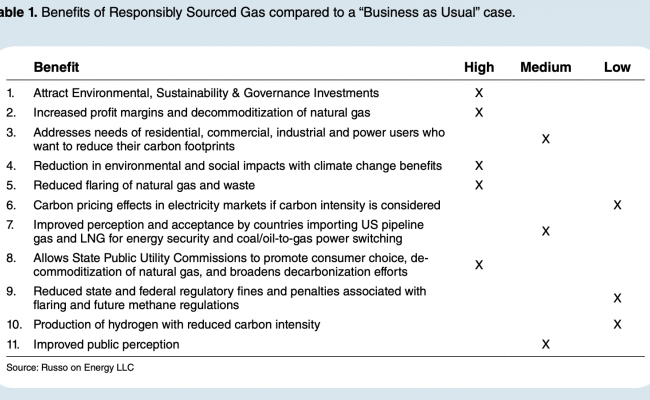

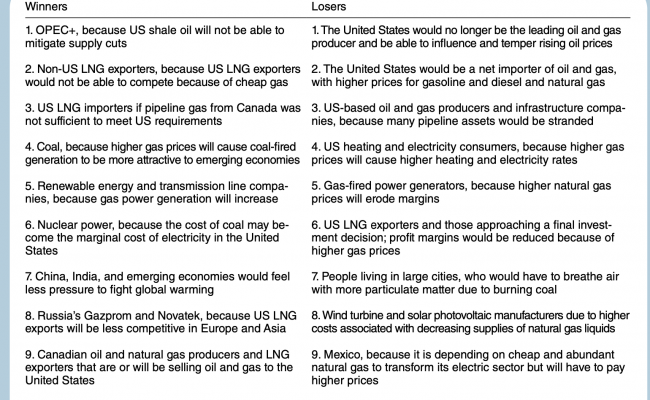

This author believes the time has come for the natural gas and LNG industry to recognize that the “bridge” for natural gas may be much shorter than previously thought. It’s time for the industries and individual companies to shelve slogans and take action to distinguish US natural gas from other global sources by embracing a narrative of “Responsibly Sourced Gas (RSG).” To do otherwise, increases the risk that natural gas and LNG will fall victim to the growing movement to decarbonize the heating, power and transportation sectors via an all electrification strategy. Federal and state policy makers, regulators and lawmakers could begin questioning whether US natural gas and LNG industries could even play a role in the clean energy economy envisioned by the incoming Biden Administration and evidenced by the Biden-Sanders Climate Action Plan. Read more by downloading the entire article [PDF] from the Climate & Energy Journal. Read more