Vintage Approaches for Planning & Regulating Sustainable Hydropower

Recently, a colleague doing work for the United Nations Development Programme in Russia requested me to send her the best guidance available on planning international hydropower projects. She was attempting to minimize impacts on biodiversity and ecosystem services. While I have been away from Hydropower for a while, I was really hard pressed to find current documents that would help her. Most reports were too general and few, if any, talked about planning and regulating hydropower projects, which can last 50 years or longer. I found this difficult to understand despite the wealth of experience in the U.S. and Canada in siting and regulating hydropower.

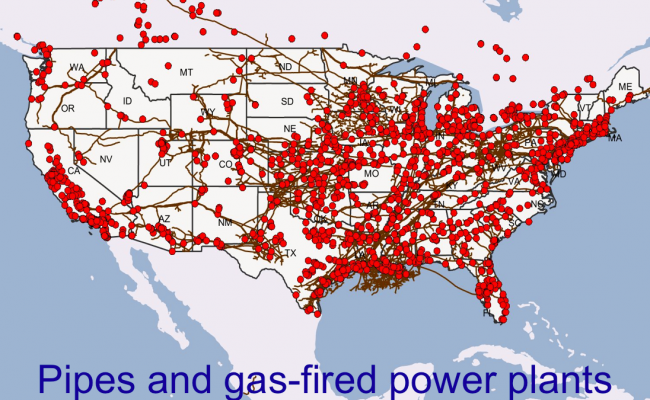

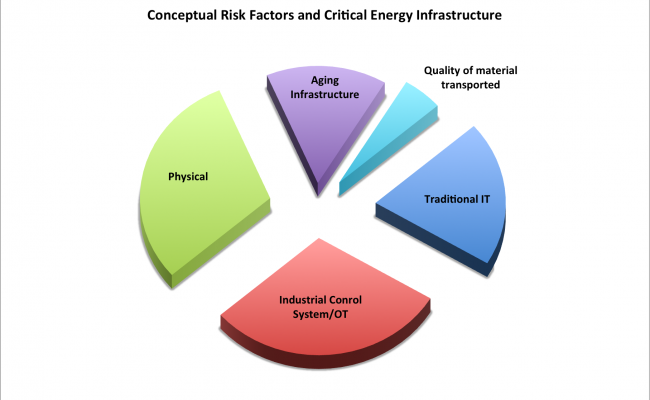

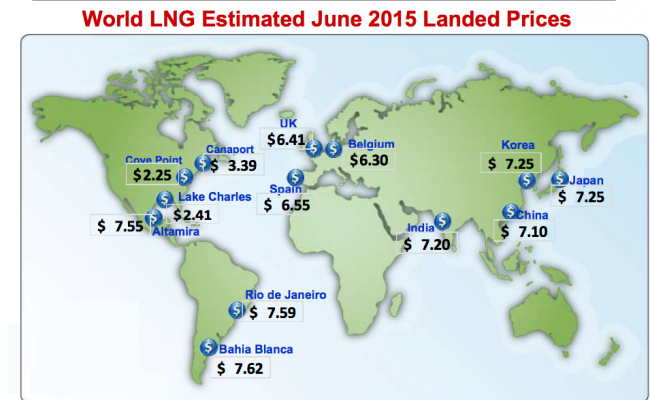

I quickly realized that in the hydro arena, we were still grappling with environmental, regulatory and social issues. The same is true for siting natural gas and renewable energy. However, the stakes are higher today since the World Bank Group and the Asian Infrastructure Bank are investing in hydropower in to spur economic development, address Climate Change and move countries away from fossil fuels. So I dusted off three publications below that should help both developing and developed countries to better plan and manage their hydropower and other energy projects. Here's a short explanation of each: